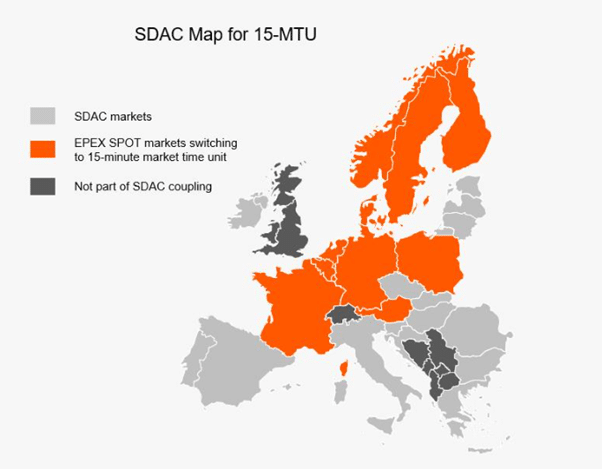

The energy market in Poland is awaiting another major reform. After last year’s balancing market reform, which brought significant disruption not only to the prices of products offered there but also to spot market prices, 2025 will be marked by the transition to 15-minute settlements on the day-ahead market (DA, RDN) as part of the SDAC (Single Day-Ahead Coupling) auction process.

What does this mean for the wholesale energy market in Poland? What effect can be expected on RDN prices and trading volume? Will this reform affect the intraday market (ID, RDB)? We’ll explore these questions in today’s article.

Current Spot Market Structure – Day-Ahead and Intraday Markets

Before we proceed to analyze the potential effects of the implemented changes, it’s worth recalling how the spot market actually works, with reference to Polish conditions.

Let’s start with the fact that three energy exchanges operate in Poland – Towarowa Giełda Energii (TGE), Nord Pool, and EPEX Spot (a subsidiary of European Energy Exchange – EEX). In this article, we will focus mainly on TGE, as it holds a dominant position in Poland regarding energy trading.

As for RDN, energy is traded “for tomorrow.” On TGE, orders are accepted until 10:30 AM on the day of the auction for day “N+1.” Results are then published on the TGE website, as well as on the websites of entities acting as TGE intermediaries, e.g., Dom Maklerski Banku Ochrony Środowiska.

On RDB, however, energy is traded “for today.” It operates according to the XBID model, taking into account cross-border exchange possibilities with other countries – contracts cover 60 minutes (1 hour) or 15 minutes of delivery [1].

Shortening the Settlement Period – A Good Change?

As of September 30, 2025, settlements on RDN will occur every 15 minutes. This means that during a 24-hour period, we will have 96 such intervals, with potentially 96 different prices.

Źródło: EPEX Spot

What was the reason for introducing such a change? First and foremost, 15-minute settlement periods will better reflect fluctuations resulting from electricity generation by weather-dependent sources, such as wind turbines or photovoltaic panels.

Furthermore, as MCSC* emphasizes, this change aims to improve grid stability, defined as maintaining its frequency within the desired range, and increase market participants’ engagement for better optimization of electricity consumption and generation.

Who will be affected by this change? Several groups can be identified that will certainly need to adapt to new market realities:

- Energy producers from non-renewable sources – through more dynamic adaptation to price signals from the energy market with four times higher frequency, they will need to more precisely optimize their power in a given time unit

- Prosumers settling in the net-billing system – according to announcements, RCE will follow changes in RDN and its settlement period will also change.

However, at present, Polish law does not mention the introduction of 15-minute settlements – appropriate legislation must go through the entire legislative process for prosumers to be obligated to settle in quarterly intervals.

Currently, we are in a situation of a legal gap that has not yet been resolved. Probably one of three options will be applied – either the hourly price for mentioned prosumers will be the price from the first quarter of a given hour (e.g., 11:00-11:15), or it will constitute a volume-weighted average or arithmetic average from four quarters making up a given hour.

- Electricity trading companies – reducing settlement periods may potentially increase the activity of trading companies, dynamically changing allocated volumes on markets (DA, ID, Balancing Market) [2].

Growing Role of International Trade – Connecting Europe with Interconnectors

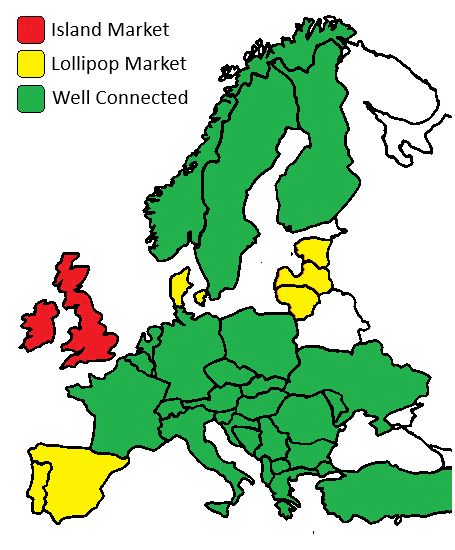

The change in the common day-ahead trading market (priced in Poland as Fixing II) is a consequence of changes occurring in Europe, aimed at creating a single European energy market. It is intended to protect individual countries from frequency fluctuations in the power system, which is extremely dangerous for all devices connected to the grid, and its large fluctuations (above 0.5 Hz in either direction) can lead to a blackout – such as recently occurred on the Iberian Peninsula.

Types of markets in Europe in the context of cross-border connections – both Baltic countries and the Iberian Peninsula have very limited cross-border exchange possibilities with neighbors (respectively with Poland, Sweden and Finland, and with France). Graphic – Phil Hewitt, Montel

However, interstate trade encounters “bottlenecks” in the form of interconnectors between different countries and price zones. It can be said that the response to price signals is measured by the availability of capacity between different zones*, characterized by different electricity prices in a given time interval.

Unexpected Last-Minute Changes – Exchange Concerns?

On May 14, less than a month before the implementation of the mentioned change, MCSC decided to give the market more time and delay the process by almost four months – until September 30.

What was behind this decision?

The official reason is “technical unreadiness,” first signaled by EPEX SPOT exchange in mid-April. Tests showed that markets were “decoupling” in 1 out of 5 cases, which represents a much higher level than acceptable to market participants. This was caused by a multiple increase in complexity at the algorithm level, which has not yet been sufficiently refined to handle the fourfold reduction in price intervals.

Despite efforts by Nord Pool and other exchanges (including Polish TGE) to implement changes on time, the delay became a fact.

What Will the Change Bring? ID and DA Connection on TGE Less Visible Than “Next Door”

Considering that 15-minute intervals on the intraday market have been with us for almost 4.5 years (introduced on December 10, 2020), it can be predicted that RDN, following in the same direction, will somewhat take away from RDB. Why? In 2024, on the RDB market, turnover was almost 22 times smaller than on RDN, despite the difference in intervals regarding settlement periods for over half a year. This difference has a chance to increase further.

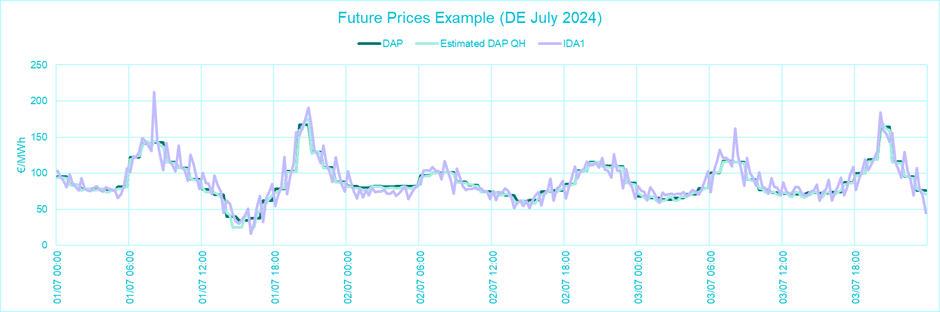

Moreover, according to analysis by Montel’s Director of Analysis Department, Andre Bosschaart, the IDA1** auction, as the one furthest from physical delivery, will be most exposed to volume loss in favor of the approaching change in the DA market.

IDA2 and IDA3*** auctions serve to rebalance portfolios of sellers and buyers – these auctions, being closest to physical electricity delivery (up to 2 hours before delivery), will probably not be as affected by the approaching change.

It’s worth mentioning that ID auctions on TGE for Poland enjoy greater interest than, for example, on competitive EPEX Spot for neighboring Germany**** – auction trading volume in Poland is larger than in continuous trading, while in Germany the opposite relationship occurs.

Currently, comments regarding the decision to change the implementation date are negative. The current system, according to traders, is not optimal, as it forces appropriate position changes at unequal time intervals for RDN (1 hour) and RDB (15 minutes). Moreover, it increases the risk of volume allocation by producers of energy from weather-dependent sources on balancing markets characterized by high volatility.

[2] https://www.tge.pl/pub/TGE/komunikaty/2025/SDAC_15min_MTU_general_information_paper.pdf

*Market Coupling Steering Committee – ENTSO-E body (organization associating all Transmission System Operators in countries belonging to this organization), which, in coordination with Nominated Electricity Market Operators (organization associating electricity exchanges), aims to integrate electricity markets belonging to it.

** In Poland, state borders coincide with the energy market price zone. It’s different, for example, in Italy, Denmark, Norway, or Sweden, where several separate price zones function within one country, between which there are differences in electricity pricing in individual time intervals.

***IDA1 – auction for the Intraday Market, which ends at 3:00 PM on day N-1 for the entire day N

****IDA2 – auction for the Intraday Market, which ends at 10:00 PM on day N-1 for the entire day N / IDA3 – auction for the Intraday Market, which ends at 10:00 AM on day N for the second half of day N (12:00 PM – 12:00 AM)

***** EPEX Spot does not offer continuous trading in Poland

Hubert Put

Senior Energy Consultant and Polish Market Expert at Montel. His main areas of interest are energy markets, energy regulation, energy innovation (primarily in offshore wind and hydrogen), and energy sustainability strategies. His work in full-time positions was focused on e.g. Local Area Energy Plans (LAEPs), Power Purchase Agreements (PPAs) and Guarantees of Origin (GoOs/REGOs) and the impact of regulatory changes on the energy industry, in Germany, the UK and Poland. Participant of the Road to C-Suite postgraduate programme by the European Institute of Innovation and Technology (EIT). Double Master of Engineering from AGH University of Science and Technology in Cracow and IST in Lisbon. Holder of the PRINCE2® Practitioner certificate and the alumnus of the premiere edition of the OECD Youthwise programme, through which he had the chance to be the voice of the younger generation on fair energy transition and sustainable development. Graduate of courses in project management organised by the University of Catania, and knowledge of energy markets organised by the European Federation of Energy Traders (EFET). One of the leaders of the World Energy Council Polish Branch. Author of a number of popular science articles on the impact of regulation on offshore wind energy or grid development, which have been published in professional media in Poland and in Germany, and co-author of analyses for e.g. Polish Youth Energy Council or UN Global Compact Network Poland.